File: 1734899835728.webp (55.28 KB, 800x1423, sub-buzz-637-1624378872-9.webp)

No. 2318104

>>2317904I have a full time job and I'm paid above minimum wage, renting in my city became even more expensive than usual because of covid and a lot of people moving here, so I still live with my parents even though I don't like it at all. I'm saving a shit ton of money that way and can indulge in a lot of things that I wouldn't be able to afford if I had my own place. I'm considering moving out very soon because not having any privacy is a pain in the ass, but everyone in my age range around me is telling me I should consider staying for as long as possible because they're struggling with rent and bills, even the ones living with roommates or their bf or gf.

>what you make at home now vs take out or buyingWhen I started my current job we were located in a different smaller office with no kitchen and when we found out the fridge was full of cockroaches and it took months to replace it I was so disgusted I just ordered takeout for lunch breaks and never stopped. I need to start cooking more often to save money, but on the other hand just thinking about this incident makes me want to throw up.

No. 2318319

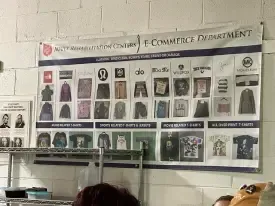

File: 1734934410539.jpg (436.93 KB, 2000x1381, kv5krpz6pecb1.jpg)

I've found that with grocery shopping, it helps immensely to create a menu as you look through the circulars. I used to just buy stuff and try to figure out what to make later, but that "I've got nothing to eat" mindset was still there. Now I write out Breakfast/Lunch/Snacks/Dinner/Misc. and read through the weekly circular to come up with ideas. If a pack of chicken breasts is on sale I'm immediately thinking of chicken with pasta, chicken on top of salads, etc. I buy the bulk from Stop in Shop, taking advantage of any digital coupon I can as well as their reward system (1 point per dollar spent which can be cashed out later OR trade in points for free items). Their produce quality is pretty crap for the price so that's where the local markets/fruit stands come in. Don't be loyal to brands and picky when it comes to your "essentials"! What I mean is if you exclusively drink non-dairy milk (and assuming you have no allergies) consider buying what's on sale for the week rather than what's not. I like oat milk but more often than not almond milk will be on sale WITH additional store coupons.

No. 2318360

File: 1734941616332.jpg (40.19 KB, 496x600, food tips.jpg)

In my experience, a lot of people are really bad at finances and that's why they aren't reaching the goals that they want to reach. I didn't learn a lot of important life-skills as a child, and that included proper financial literacy. When I was a young adult, I struggled to make ends meet and I struggled with my finances for a while. I was in denial about my own faults, and instead of admitting to them, I blamed the economy for all my woes. Looking back, I'm a little embarrassed by my behaviour back then. As I got older, I got sick of it and decided to take more responsibility for myself and for my actions. Through a lot of self-work, learning, research, and formative experiences, I'm much more financially literate now and I'm proud of the progress I made. I wanted to share a bunch of my tips, but as I was typing out my first one I got kind of carried away, so this post will just have my tips when it comes to food.

>The problem with food and nutrition.

I think food is one of the biggest hurdles for financial freedom and independence. I've seen it again and again: a random 20-something with a cushy job complaining about how food is so expensive nowadays, all while sustaining themselves on fast food ordered from Uber Eats or DoorDash, all while struggling to fry an egg. A lot of adults my age, in their mid-20s, don't know how to cook; they don't know how to effectively shop for groceries; they don't know how to plan meals; and, most importantly, they don't realize how important it is to be frugal when it comes to food.

>Take-out food & delivery services.

Before I talk about anything else, you have to realize that take-out and food delivery are some of the stupidest things that you can do if you want to save money. Every type of food that you want from a restaurant can be made at home for cheaper, with a lot more nutrition value. I'm not saying "oh, never go out to eat," but what I'm saying is that a lot of restaurants are rip-offs, especially fast-food restaurants. When you couple the high price of fast food with the even higher price of food delivery services, you end up draining your wallet quickly. On most food delivery services, the price of the food there is inflated by around 10-30 percent, e.g., McNuggets ordered on UberEats are about 20% more expensive than the McNuggets ordered from the drive-thru. One of the best things that you can do for your wallet is to re-categorize how you view eating out and going to restaurants. In your budget, eating out should be categorized under "entertainment." Eating out is an experience, and it's a luxury, it isn't just nourishing your body. It's about going to the restaurant, sitting down, being waited on, enjoying conversation with friends or family, etc..

>Knowledge on cooking.

I'm not sure why this is, but I've noticed that a lot of friends my age don't know how to cook. They might know how to cook in theory, but they don't understand the idea of cooking. You want a balanced meal, one that's nutritious, delicious, and balanced. Every meal should have some protein, some carbs, and some fat. If it doesn't have all three, it's not a meal. For example, ramen noodles from a cup isn't a meal on its own. If you don't know how to cook, there's thousands (if not millions) of recipes that you can find online for beginners. There's really no excuse for not knowing how to cook anymore. My parents never taught me how to cook, but I learned all on my own from the internet and from cookbooks. It took me a while to get good at it, but now I'm way better off for it.

>Shopping for groceries.

A lot of my friends that work minimum wage jobs think that they're above couponing, and they shop at the most expensive grocery stores. Obviously, this is a big mistake. If you live in an area with a lot of different grocery stores around, take a day where you just go in and look at the prices of things. For me, grocery store A always has cheaper meats and cheeses than grocery store B, but B has cheaper baking supplies and grains than A, so when I go grocery shopping I go to both stores to maximize my savings. I always go to the grocery stores that advertise themselves as budget-friendly. Besides shopping at appropriate stores, I also make sure to stay up to date with coupons and sales. Where I live, grocery stores do new sales every week. They upload fliers online, so I go to their websites and check out what the sale is for the week. If they're having a sale on essential things that I'll always need, like say shampoo, body wash, toilet paper, dried goods, canned goods, etc., I'll be sure to allocate funds to buy a decent amount of that product. For example, I usually buy a 4 month supply of toilet paper whenever it comes on sale, because I know it's a product I'll always need. Another good idea is to look at the price per gram of food items, most of the time this will be posted on the price tags, but if not you can do simple math to figure it out. For example, at my grocery store, 500g of rice costs more per gram than 1000g of rice, but 1000g of rice costs less per gram than 2000g of rice. So whenever I need rice I always buy the 1000g option because it's the lowest price per gram for the item. This is especially important to consider if the item you're buying comes in a variety of different size options, because the biggest (or heaviest) option doesn't always equate to the cheapest

>Planning meals.

This ties into the tips on cooking and grocery shopping. You should be planning your meals for the week before you go grocery shopping. Planning your meals can provide better nutrition, save you time cooking, and it can help make grocery shopping easier and cheaper. You can find calculators online to discover what your ratio of macro-nutrients should look like, but, in general: a meal should be composed of 50% protein, 30% carbs, and 20% fats. With this in mind, you can plan out your meals ahead of time so that you can get proper nutrition every day. Before I started meal-planning, I exerted a lot of time making a decision on what I should eat for the day, but with meal-planning it makes it so that I don't have to exert energy on decision-making. Planning your meals makes it so that grocery shopping is a lot simpler and more efficient, especially if you consider sales and coupons when you plan your meals. E.g., if I know there's a sale on tomatoes that week, I'll make sure that a lot of my meals will have tomatoes as an ingredient. When you plan your meals effectively, you reduce food waste and wasted money. For example, I never buy frozen french fries because although they're quick and easy to make, I know that my money would be better spent on buying a bag of potatoes because potatoes are a much more versatile ingredient; they can be made into a lot of different meals, rather than just french fries.

These tips are just one way to improve your financial well-being when it comes to food. We all need food to live, but a lot of people spend way too much money on food, sometimes to the point that it becomes one of their biggest spending categories. Food will always be something that you need to spend money on, but with these tips you can minimize the amount of money that goes towards food and maybe make some better choices that will positively impact your financial situation. I wrote a lot, sorry to sperg out, but I saw the thread and wanted to contribute something that others might find helpful.

No. 2318380

>>2318360Well said nona, this is the expanded version of what I was getting at earlier

>>2318319>>2318371Couponing also gives a bit of a rush imo. I don't live somewhere that allows stacking hundreds of coupons the way they do on Extreme Couponing, but seeing the "You Saved…" section on the receipt is always exciting. Aside from in-store deals/coupons did you have any specific websites you went to for couponing?

No. 2318418

Getting a library card saved me a shit ton of money. I had one for free and another one for just a few euros, more or less the price of one book, for another city but since both cities are very close to each other I can easily access both of them. When I started university I finished classes very late and had lectures almost every Saturday, and I was busy with assignments so I couldn't go to the library anymore, it got me in a bad habit of buying manga and novels that I ended up not liking all that much so I sold them later but in the end it made me lose what was a lot of money for the broke student I was. So now I read whatever I can get in the library and will only buy what I really liked. I also borrow DVDs and save money on online streaming subscriptions.

>>2318188I really should. I was already gifted a bottle like that a few years ago, kept taking it with me in the previous office but the only way to get more water was to either take the plastic water bottles the company bought for us or fill my own thermos bottle in the sink in the bathroom so I also lost that habit. I also always had to take it home with me all the time because no lockers. I should use it everyday again, none of these things are an issue anymore so we don't get anymore free water bottle paid by my employers. It would help me be less tempted by sugary drinks as well when ordering takeout.

>I never, ever, <i>ever</i> put my food in the breakroom fridge. Ever.I do it the few times I can't finish my meal but once someone threw my leftovers in the trashcan so I don't like putting my food in there either, even though cockroaches aren't a problem anymore. More than half of the people in the office are people I don't know so I can't trust them and they're always in the kitchen.

No. 2318429

Top tip for ginger and garlic: if you don't end up using large quantities of ginger - stick it in the freezer and then grate it frozen whenever you need it. I've had the same knob in there for like 3 months. With garlic, make a paste and freeze it portioned out.

I also reuse baking paper, just use common sense and don't reuse it if it's completely trashed.

The whole "see, smell, taste" is a winner for so many foods, the use by dates are a suggestion rather than a rule. Obviously don't eat old ass meat, but use your discretion on most other things.

This is more dependant on where you live and whether you have the space, but obviously pickling and fermenting things is a godsend if you live in a cold ass place that has horrible vegetables for like 6 months of the year. Obviously need some investment in the beginning if you don't have jars and the like, but most people have a collection of random jam jars in some cupboard anyway.

Baking bread is of course a meme from covid times but I live far away enough from the store that its become a habit and I keep it simple, no wild kneading/rising rituals - just basic whole wheat.

As nonnies said above, food is the biggest culprit to financial flexibility that's actually variable. There's very little you can do to pay less rent for example, your electricity bill will probably be around the same because those habits are pretty standard, you'll still have to pay for insurance/gas for your car. So definitely integrating some of the suggestions in this thread with food/cooking will make a difference.

No. 2318437

>>2318429>The whole "see, smell, taste" is a winner for so many foods, the use by dates are a suggestion rather than a rule. Obviously don't eat old ass meat, but use your discretion on most other things.IMO it's just better to play it safe and eat foods within the suggested dates, unless it's something that lasts a while like apples/beets/etc or can be frozen. Old food might not make you completely sick but can still give you really bad stomach cramps, as I've experienced. Plus I kind of feel that if you have food sitting around beyond its expiration that means it wasn't being eaten anyway.

>>2318418Yeah a library card is great. At my college they use interlibrary loan so I've been requesting books from other libraries instead of buying them. I grew up in a town without a library so I had always bought a lot of books instead of seeing if a library had them first.

No. 2318484

Not a burger, so idk how effective some of my tips are.

As for food, preserving fruits, vegetables and even meat (beef is the better option for that imo) in jars. If you don’t have empty ones, start keeping jars after you use their contents up - pasta sauce, olives, doesn’t matter, if the jar is made out of glass and the lid is made out of metal, you’re good. Jams, pickled vegetables and vegetable paste can last you an entire winter if sealed good and meat up to 3 months maximum. Yes, it’s a time consuming process and requires some trial and error, but it’s worth it in the end.

If you’re lucky and have or know a grandma who was a garden, hens or cows and can either sell some of those good for cheap or in exchange for helping her with things like errands or helping around the garden for example. If not, Facebook groups from your place can have announcements from farmers popping up from time to time with stuff that is surplus, if they don’t have inflated prices because of the “small business” excuse tho.

Byuing seasonal fruits and vegetables is also a good saving option. For example, buying forest fruits in season is better than buying their frozen version in the winter, that version tastes like nothing and is also expensive.

For entertainment, this one is pretty controversial, but cutting on streaming services. 2 streaming services are enough in my book - one for movies, one for music if you cannot pirate or YouTube mp3 your way out. Not applicable to all of course, but I have encountered some people my age complaining about how shit’s expensive, but they got 4 streaming services minimum that they pay for monthly.

Not entertainment necessarily, but subscriptions for data plans are garbage most of the time. Depends on where you live, but prepaid offers are much better. The only 2 downsides are not having the offer for an entire month (20 something days here) and not being automatically renewed when it’s over.

Borrowing books from a library or even a friend if you don’t like eye strain that comes with reading PDFs.

Apologies for the spergout, I hope my rambling might help someone.

No. 2318512

>>2318437>IMO it's just better to play it safe and eat foods within the suggested datesThis is the frugal thread, not the normies obey the arbitrary corporate rules thread. If it doesn't smell, taste, or look off, it's fine

>>2318510Microgreens are also a really good choice if you live in an apartment. It's a two week commitment that you can stop anytime.

No. 2318518

File: 1734963901639.webp (65.51 KB, 640x480, IMG_7359.webp)

>>2318512>This is the frugal thread, not the normies obey the arbitrary corporate rules thread. Just because you think it's fine to cut mold off of cheese and bread doesn't mean everyone else has to take a risk with their food.

>>2318517Too late.

No. 2318522

>>2318512Some harmful bacteria don’t change how food looks or smells, so it’s good to check storage and expiration too.

>>2318519"Thrifting has turned into another consumer nightmare. People are buying just to buy, or worse, to resell online at absurd prices. A couple of years ago, finding good stuff was so much easier. My local thrift stores are boring now. I almost bought a nice chair recently but hesitated—then saw someone selling the same chair online for a fortune the next day, using the store’s photo! Same with a piece of furniture: €80 in-store, flipped to €800. I can’t stand these people.

No. 2318539

I'm a burger, so advice might be burger-y. Biggest hacks for me have been prepaid phone plans (T-Mobile gives you 5GB of data for $15 a month), pay-per-mile car insurance (if you don't drive a lot and have decent credit, it'll save you sooo much money), religious coupon clipping/taking advantage of sales and buying staples at places like Aldi, eating out max twice a month, and also pirating all my media and cancelling Spotify/Netflix. Spotify Premium is getting harder and harder to properly crack, so I'm planning to set up a tiny home server to replace it. Oh, and if I want a big purchase (something over $100), I set up sale alerts on secondhand stores and patiently wait for good deals. I especially like Swappa for secondhand electronics. I also do anything I can to save money at the local library. My library has 3d printers for example, so if I want nice QOL stuff like pill boxes and toothpaste squeezers, I just print it for free. Free scanners, free printers, free books, free DVDs, free park passes, free tote bags during events, just really lots of nice little gems.

No. 2318568

>>2318437You've been brainwashed nonette, if it's in sealed, not bloated packaging you're 98% fine. And like I said, discretion is key - use your senses, you have them for a reason. Milk is a good example

of something that usually has a super deceptive use by date, and is very obvious when it's "off", so why waste it? Anecdotally, I've never noticed any stomach issues while doing this.

No. 2318617

>>2318568Sometimes senses don't work, as

>>2318522has mentioned. I also put in my original post that I've had personal experience eating food past the date that seemed fine while eating, and gave me severe abdominal pain hours after eating it. It's not worth my time to get sick from old food.

No. 2319332

>>2318443>Living with parents is one of the biggest crutches100%. A lot of people my age are in denial about this big time. Friends around my age that live at home spend way too much money on frivolous things like food delivery, merch, plastic garbage, drugs, etc., all while having no goals for the future. I have an acquaintance that makes more than I do, but at the end of the month she has no money left over even though she lives at home and doesn't pay any rent, meanwhile I still manage to stash away money towards savings while renting. It feels like way too many people over-rely on their parents, and in doing so they hit pause on their own personal development and halt their financial progress. I think there's way more benefit to living on your own, outside of the family home, just in terms of personal growth and discovery. I grew up a lot in the first year I moved out of my parents' house, and I changed a lot for the better. The sooner a person enters the real world and has bills to pay and rent to pay, they start gaining experience and learning. If someone stays at home forever, they're always missing out on that experience and when they finally do move out of home they're under-prepared. I have friends that are close to 30 that still don't know how to pay phone bills, use public transportation, or rent an apartment. These are major hindrances that they're dealing with now because most of us learned all that stuff a decade ago.

I always hear the "but rentals are too expensive now" line, but it's always coming from people that want a 2 bedroom apartment all to themselves in a downtown core. I rent a 3-bedroom unit and I have roommates, and that cuts down the cost of renting by a lot. A lot of people feel entitled to living alone, but that is definitely a luxury.

Obviously this doesn't apply to everyone, I have friends that live at home but save a shit ton of money because they wanna skip renting and just buy a condo to move out into. I guess it all depends on personal goals. I think everyone should have a 5-year financial plan that they're working towards.

No. 2319386

>>2319332>I think there's way more benefit to living on your own, outside of the family home, just in terms of personal growth and discoveryIt depends on where you live and what's the average wages in that location. Sometimes I hear about rent prices in some cities and countries like the big cities in the US, in Australia and in Ireland and if I had to live there by my own I'd be worried sick over not earning enough money to pay for the bare minimum. A good compromise would be if adult kids who work treat the family they live with like roommates they're related to and like and not like mommy and daddy giving them everything on a silver platter. The other extreme is when kids are stuck with insane parents who see them as walking wallets and they make them pay a full rent for staying in their room as soon as they turn 18 so they can't save money to get out and invest in other things like driving lessons, school, moving out.

I knew in university a lot of classmates with rich parents who lived alone, skipped classes to have part time jobs, seemed responsible on the surface but then they admitted their parents paid for everything so they bought stupid expensive things all the time for no reason. The same classmates thought I was an immature kid for living with my parents and not working while attending classes until they learned we were so poor I could get a scholarship, but that meant I wasn't allowed to skip classes or I'd have to pay the scholarship back. The people I know who moved out the earliest were crazy rich kids whose parents own several houses and apartments so they never really learned, except for one who moved to another country after graduating and got married to a local.

No. 2319401

>>2319386It definitely depends on the country a person is in and the wages there, but at the same time I think it should be the ultimate goal to move out and start your life on your own. I live in a HCOL area, and I can still make ends meet by having a full-time job in my field of study, by being a freelancer on the side in domains that I have skills in, and by making smart financial choices that serve my long-term goals.

A lot of people from poorer background don't have a strong grasp on financial literacy, that's actually one of the reasons why they're poor in the first place. In my poorfag household growing up, we never saved, we never invested, so when I was an adult I had to learn all that stuff on my own. My family is still poor, and the more financially literate I become the more I realize that their economic situation is caused in large part by their ignorance and poor financial decisions. If I stayed at home forever, I wouldn't have been exposed to the financial stresses that challenged me to overcome my ignorance and to become more financially literate, I would have carried on just like my parents did and stayed poor forever.

>I'd be worried sick over not earning enough money to pay for the bare minimum.It's normal to worry, I don't think people should be scared of this. I actually think too few people worry. Obviously it shouldn't consume you and keep you up at night, but I think a normal amount of worry is healthy and actually pushes us to make smarter choices and to re-evaluate our situations. When I lived on my own, I was stressed out about making rent all the time. That stress ended up convincing me that it'd be better if I lived in a shared-apartment with roommates, and that choice was great for my finances and for my social life. When I was stressed out about the amount I was paying for streaming services, that helped me look into ways to get these things for free and I taught myself how to pirate stuff. Stressors can help us grow and change for the better.

>A good compromise would be if adult kids who work treat the family they live with like roommates.>Parents who see them as walking wallets and they make them pay a full rent for staying in their room as soon as they turn 18.This is part of the problem. A lot of adult children want to stay at home for long periods of time without actively contributing to the household finances. A person can't be treated as a roommate when they don't pay rent. When I moved home for a year after university ended, I still paid my mum money for my rent. I don't think its fair for adult children to stay at home rent-free. My mum hated the fact that I paid her, and it was a fight to get her to accept money at the end of the month, but I think it was still the right thing for me to do. Paying rent (or mortgage) is a part of life, the sooner that a person learns how to do this, the better it is for them. Some financial guides say that rent should consume no more than 30% of your monthly salary, so if a person lives at home and doesn't pay rent, then they should be saving at least 30% of their monthly earnings to emulate paying rent to prepare themselves for when the time really comes.

>The same classmates thought I was an immature kid for living with my parents and not working while attending classesJudgemental people are everywhere, it sucks that we can't support each other and be free of petty stuff like this. I'm happy that you got the chance to go to school, & I'm sorry you had to deal with the quick judgements of richies while there.

No. 2319471

>>2319451Well, this is kind of a big question. For a few quick answers:

>Dedicate 3 days a week where you don't eat any meat.A lot of people over-indulge in meat, which can usually be one of the more expensive things purchased at grocery stores. You could try substituting it for tofu some days. Tofu is a very cheap food, and like chicken it takes on the flavour of whatever seasoning you add to it. If you can dedicate three days a week to eating a meat-free diet while still getting the required protein for the day, it saves a lot on grocery bills.

>Cut out all snack foods in favour of proper hearty meals.People tend to snack on food when they're not really full or nourished by their meals alone. This is usually because a person isn't eating enough protein in the day, as protein is the macro-nutrient that keeps you full for longer. Most snack-foods are unhealthy, and in the end they don't actually satiate your hunger. It's better to save money and avoid buying snackfoods.

>Choose generic or store-brand foodstuffs over branded foodstuffs.Sometimes store-brand or generic items are cheaper than branded items. For example, my usual grocery store has a generic brand of cheese that's 40% cheaper than branded cheese. Sometimes, generic will be pricier than branded, and sometimes generic will taste "off" compared to branded, so it's kind of a live-and-learn situation.

>Frozen goods over fresh goods.Why buy fresh fruits or vegetables at premium prices when frozen fruits or vegetables are very nutritionally similar and much cheaper? The general rule is that if you're baking with vegetables or fruits, or if you're cooking with them, opt for frozen varieties. Fresh fruits and vegetables work best when you're just consuming them raw. E.g., if I'm making a smoothie, I'd opt for frozen fruits, but if I was just plating fruits to serve with whipped cream I'd go with fresh fruits.

>Buy a bulk protein powderThis is sort of a weird one, but I bought a huge bag of protein powder for like 60 dollars, and it's good for 150 servings. Whenever I'm feeling hungry, or like I didn't eat enough, I just make a smoothie with the protein powder. Protein fills you up, and usually a lot of protein powders are also enriched with essential nutrients and important vitamins, so it always leaves me feeling fuller and energized than just snacking on something or ignoring my hunger pangs.

You could also read posts like

>>2318360 &

>>2318319 to get a better idea on how to save money when it comes to food.

No. 2321420

Re-contextualize money. Use your hourly wage as a guide for purchasing.

For example, let's say you make $20/hour. If you want to buy something that's $10, think to yourself "hm, I'd have to labour for 30 minutes to have this item, is 30 minutes of my time worth it for this?" Or: "Hm, this item is $200, so I'd have to labour for 10 hours to afford this." Doing this helps me determine is something worth the money or not.

I really wanted to buy a new sofa recently, even though there's nothing really wrong with my old one. I did the math, and I'd have to work 36 hours to have the money to buy it. A new sofa isn't worth 36 hours of my labour. I found another sofa that was only worth 12 hours of my labour, and that seemed much more reasonable to purchase.

Before I started doing this, I looked at money differently. It was like in my head, money and labour were divorced. I could only contextualize purchases based on their monetary value instead of the value of the work I did.